Goldma

- Dapatkan link

- X

- Aplikasi Lainnya

Goldma: A gold mining cryptocurrency investment opportunity in Zimbabwe

Gold is a historically popular investment, offering a unique source of secure wealth. It remains the precious metal of choice for those seeking to diversify their portfolio and protect themselves from the hazards of fiat economy. Buying gold today does not necessarily mean acquiring physical gold; it is often considered both easier and much more profitable to get shares in gold mining companies.

However, investing in mining projects tends to have its own difficulties. For one thing, there is no way to know in advance whether any given project will actually succeed. For another, the traditional methods of trading gold mining shares are notoriously complex and come with significant transaction costs. Meanwhile, the companies themselves suffer from archaic and cumbersome financing mechanisms, largely tied to banks. Goldchip Investments (or Goldma), a Zimbabwe-based gold mining and mineral processing company, offers a new way to invest in its operations through its own cryptocurrency, making the risks and the rewards more accessible than ever before.

What does Goldma offer to its investors?

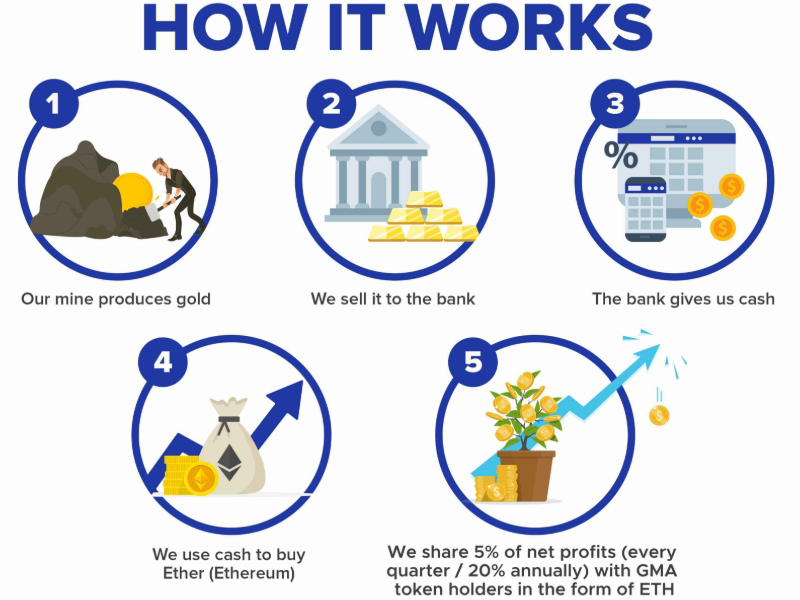

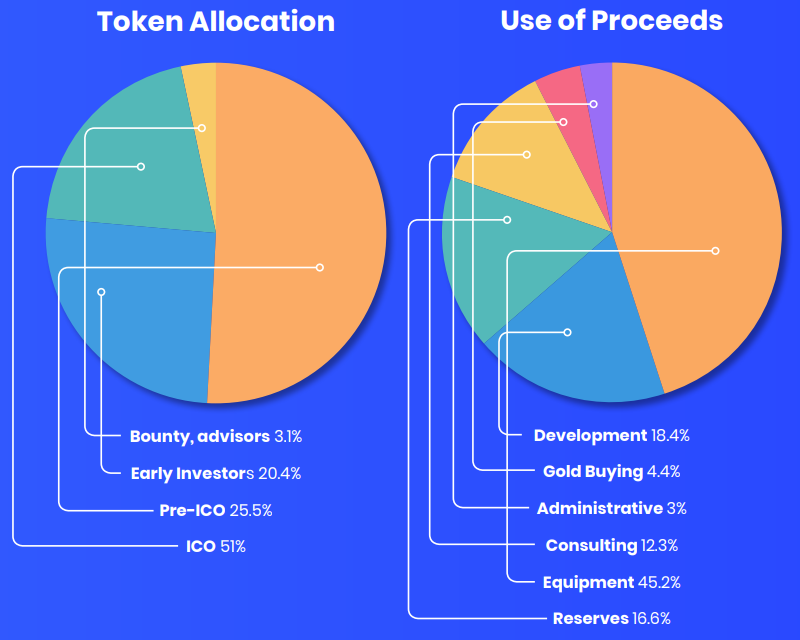

Goldma's proposal is very simple. Investors will be able to buy Gold Mining Asset tokens (GMA), with the proceeds going towards different sides of the company's operations. In exchange, GMA holders will be rewarded, automatically and directly, with 5% of the company's net profits in ETH on a quarterly basis through the use of smart contracts. The tokens will be fully tradable on third-party cryptocurrency exchanges.

As for its profits, the company intends to derive them directly from mining and processing in the Sunrise 60 Project Area in the gold-rich country of Zimbabwe. Goldma's main initial focus on the extraction side is open-pit mining (extracting ore from the surface), while processing will involve milling and leaching with the help of a cutting edge CIP (carbon-in-pulp) cyanidation facility. This will allow gold to be extracted with maximum efficiency from relatively easy to mine ore.

Why does this project stand a chance?

By tying its tokens to gold mining securities, Goldma hopes to cancel out the inherent volatility of cryptocurrency. That would make GMA a very appealing prospect for cryptoinvestors looking for a more stable source of income, that it is also not strongly tied to fiat. However, this hinges entirely on the success of the company. Investing in gold mining has some inherent risks that are multiplied when the company is operating in a politically unstable country like Zimbabwe.

On the other hand, Zimbabwe is currently showing some signs of becoming more stable. The desire to revive its economy has caused its government to become more open to investment and innovation. If those trends continue, then Zimbabwe's vast and largely untapped mineral resources could make it a very promising area for gold miners and their investors.

Goldchip Investments has significant advantages when it comes to this market: It has experience and credibility in the country, it has received an award from the Zimbabwe Investment Authority, and it is already fully licensed. The company has 16 contiguous claims in the Sunrise area (known to be rich in minerals, but so far poorly developed) and has so far been exploring two of them, leaving it with plenty of room for growth.

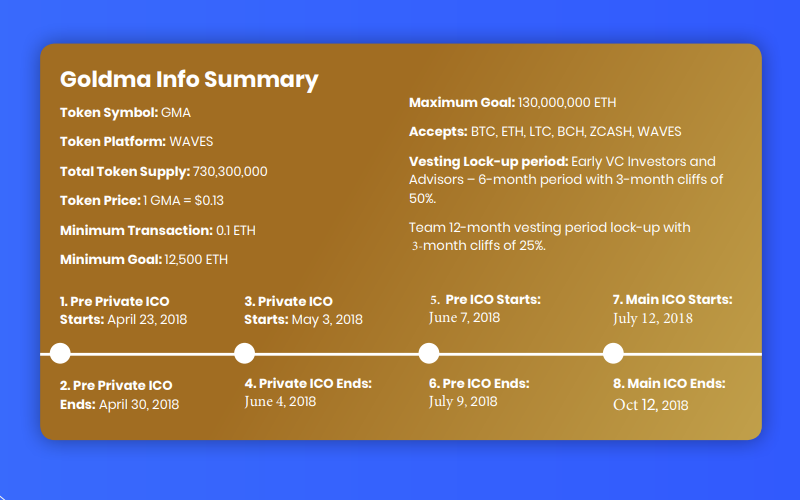

Token sale details

A risky but lucrative bet offered to cryptoinvestors

Zimbabwe has been enjoying a great deal of attention from foreign investors over the last few months. The promise of economic liberalisation under the new government has left some expecting a major boom and wanting to become a part of it. Others caution that it may not pan out, as a renewal of political instability could override any progress made. It is a classic situation: anyone who invests in Zimbabwe is betting on the country's future. If all goes well, though, those early investors would be in a unique position to benefit from its success.

Though gold is often seen as a secure long-term investment, investing in any given mining company is a gamble in itself. Goldma's operations seem to have advanced far enough that it is not a total shot in the dark, but many risks remain. Ultimately, however, Goldma offers a unique opportunity to make this bet easily and at a comparatively low cost. If it succeeds, it will bring a stable income to its investors and also prove the viability of its model, allowing others to imitate it. That would be very beneficial to both gold mining and Zimbabwe.

Links:

Website: https://goldma.io/

WhitePaper: https://goldma.io/assets/files/GoldmaWhitePaperV9.pdf

Telegram: https://t.me/joinchat/He_y1hHwCYJ0Rr01xXJZEQ

Facebook: https://www.facebook.com/GoldMAZimbabwe/

Twitter: https://twitter.com/GoldMA_Coin

Medium: https://medium.com/@goldma

ANN: https://bitcointalk.org/index.php?topic=3314372.0

WhitePaper: https://goldma.io/assets/files/GoldmaWhitePaperV9.pdf

Telegram: https://t.me/joinchat/He_y1hHwCYJ0Rr01xXJZEQ

Facebook: https://www.facebook.com/GoldMAZimbabwe/

Twitter: https://twitter.com/GoldMA_Coin

Medium: https://medium.com/@goldma

ANN: https://bitcointalk.org/index.php?topic=3314372.0

Profil

Wallet

0xfcf72a4e323B196e52D0Cf44362d0eca4E418fFe

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar